Introduction

In this article, we will tell you about retirement preparation and also tell you what steps you should take to make your life secure and satisfied and towards the future which will prove to be beneficial for you.

Table of Contents

1.Assess your financial situation

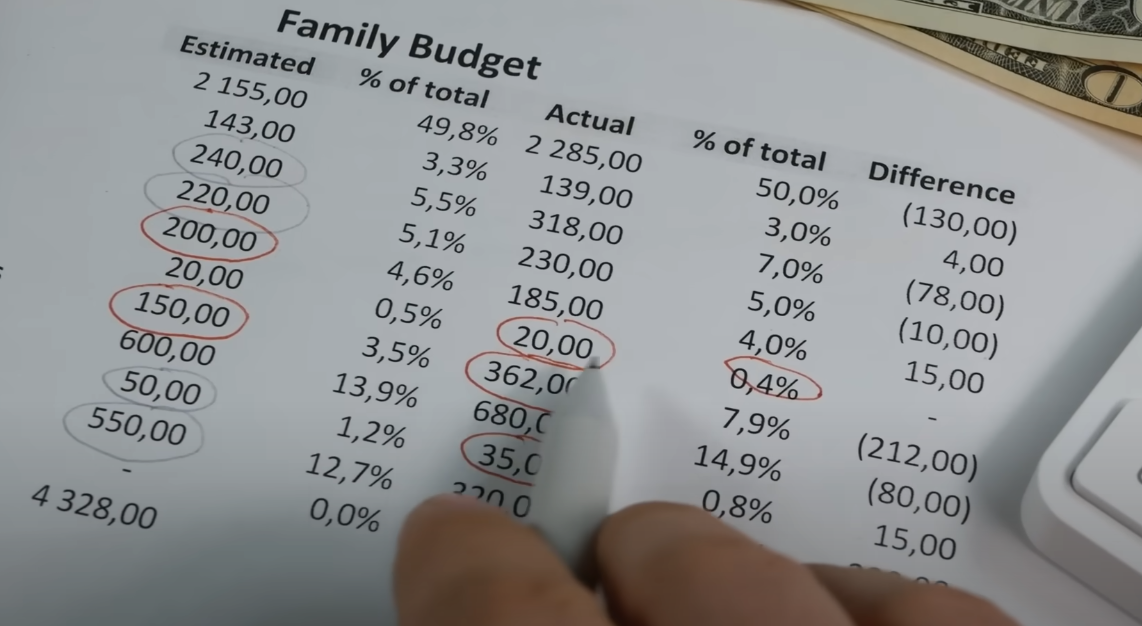

Analyze your income and expenses

You have to analyze your financial expenses after retirement and also make a complete list of your monthly income, savings, investments, and expenses. Which will help you understand how much money you will need after retirement.

Estimate the amount needed for retirement

To reduce your expenses after retirement, you can estimate how much money you need for your health care. For this, you can also use compass math. You should keep 70%-80% of your income after retirement.

2.Make a savings and investment strategy

Start early

Invest in retirement plans

There are many retirement plans available in America such as National Payment System, Public Proceeding Fund, Citizen Savings Plan. By investing in these plans, you can save tax as well as earn regular income.

Diversified investment

You can invest in diversified investment. In this, you get more returns by investing in options like mutual funds, stocks, fixed deposits. The risk in this is very low.

Also Read-how to get rich with no money 8 best ways

3.Health insurance and emergency fund

Take health insurance

After retirement, your medical expenses increase. For this, take a good health insurance plan which will cover medical expenses on hospitalization. For this, choose a better insurance plan which can meet the needs of you and your family.

Create an emergency fund

After retirement, you have to maintain an emergency fund equal to at least 6 to 12 months of expenses. Which is important for your doctor emergency or other person couples.

4.Plan lifestyle

Decide the lifestyle after retirement

Make some plan of how you want to live your life after retirement. Do you want to travel abroad today? Or do you want to do something new? Or do you want to spend time with your family? You should set financial goals for your lifestyle based on retirement.

Pay attention to mental and physical health

After retirement, you do not have to limit yourself to financial matters. But you also have to maintain a healthy diet and participate in social activities. This is how you will keep your body healthy. Therefore, you people should make a habit of meditating and participating in social activities. Which is important for your mental health.

5.Legal and property related preparations

Will and nomination

You also have to keep a will in which the distribution of assets is according to your wish. Like all bank accounts and investors, there should be a nominee for nomination without a policy. Now how to update your will without a policy.

Power of Attorney

After retirement, you want to give your property to whom. For this, you can use the Power of Attorney, which will tell the person to whom you want to give your property for care.

Conclusion

In this article, we have told you how you can choose your option after the requirement. You should invest, do regular savings and plan your life style which will help you to declare retirement yourself. You can live your dreams and enjoy living. For this, you should prepare the right plan after retirement. You can make the most of your retirement. For this, you should assess your financial situation. For this, you can consult a financial advisor.

(FAQ)

1.How early should you start planning for retirement?

You should plan for retirement from retirement first because the sooner you plan, the better it is for you and you can get maximum benefit from compound interest rate.

- How much should I save for retirement?

You have to depend on the expenses in your lifestyle. You should assess your current situation and save your income for retirement needs.

- Is health insurance necessary for retirement?

Yes, health insurance is necessary for retirement because medical expenses increase after retirement.

- What can be the sources of income after retirement?

After retirement, you can get today’s formula by joining pension, savings, mutual fund, or other government scheme.

- Do I need a financial advisor for retirement?

Yes. You may also need a financial advisor who can help you in planning your retirement.