Introduction

Today, to fulfill your financial needs, you have to go through some process to take many types of loans. Whether it is to build a house or buy a house or to fulfill personal needs, loan can be an important option.Personal Loan vs Auto Loan: What is 5 Difference? Choosing the right option from the different types of loans is important. Personal loan and portal loan are two such loans that help you to use your financial needs based on your needs. We will tell you about the intro features between the loan and the details of its use, as well as we will understand how you can fulfill your needs by using these loans.

Table of Contents

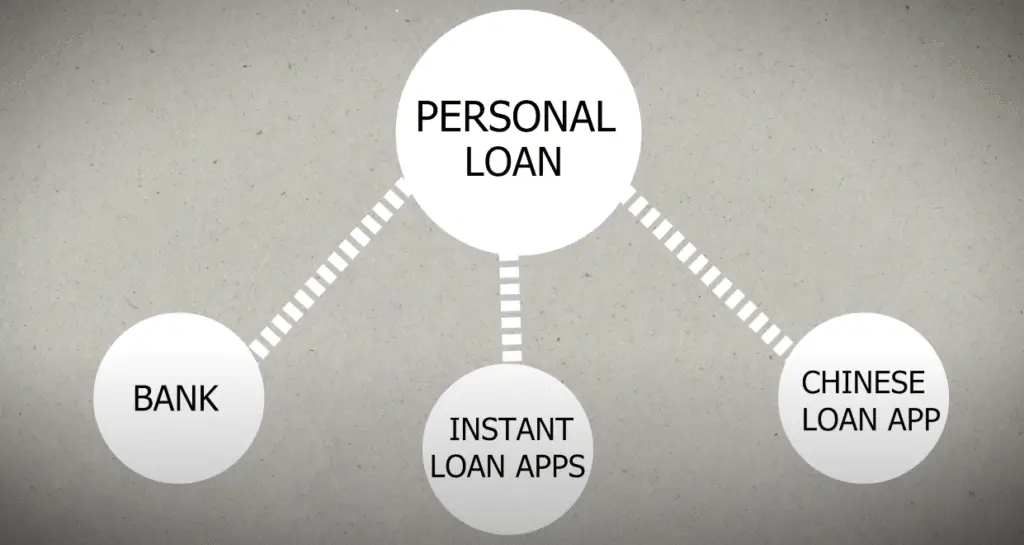

What is a Personal Loan

With a personal loan, you can fulfill your financial needs. Personal loan is an associate loan. In this, you do not need to give any guarantee or property. This loan can be very useful for you. Its purpose can be used for medical expenses, travel, marriage or other personal needs.

Features of Personal Loan

- Flexibility: It can be used for any purpose.

- Interest Rate: The interest rate of personal loan is usually higher than other loans because it is an unsecured loan.

- Loan Amount: Usually this loan ranges from ₹ 50000 to 50 lakhs.

Benefits of Personal Loan

- No Restrictions: You can use the loan as per your wish

- Loan Speed: The process of personal loan is very fast and you get it within a few days.

- Minimum Documents: For this you need very few documents.

Disadvantages of Personal Loan

- Interest Rate: Due to it being a loan, it is very high.

- Short Tenure: You get a period of one to 4 years to repay the loan

- Credit Score: Due to low credit score, it becomes difficult to get a loan.

What is an auto loan

Auto loan is a famous loan in which you can buy your vehicle. So you can mortgage your property. You can use your motorcycle or other vehicles.

Features of auto loan

- Secured loan: In this, you can mortgage your property.

- Interest rate: In this loan, the interest rate is lower than that of a personal loan.

- Loan amount: In this loan, you can get 70 to 90% of the value of the property.

- Tenure: In this, you get a tenure of one to 6 years.

- Personal Loan vs Auto Loan

Benefits of auto loan

- Interest rate: Due to low interest rate, the loan is secured in this.

- Long tenure: You get more tenure to repay the loan, due to which your EMI can be less.

- Easy approval: Due to the mortgage of the property, you get the loan easily.

Disadvantages of auto loan

It is used only for buying a vehicle. In this, your vehicle can be confiscated due to non-payment of the loan. And at the same time you have to pay excessive expenses like insurance and registration.

Which loan is better for you?

Which loan is better for you, personal loan and auto loan, which loan should you choose. It depends on your particular situation. If you want to buy there, then you want a long term loan with low interest rate. On the other hand, you can get a personal loan by mortgaging your property to complete your son’s plan.Personal Loan vs Auto Loan

Conclusion

In this article, we have told you about the difference between personal loan and auto loan, when you can choose which loan according to your need. There is a personal loan but the interest rate in it is high. Auto loan is available with low interest, in this you can only buy a vehicle. Assess Rahu credit score and repayment capacity in both the loans.

FAQs

- Why is there a big difference between personal loan and auto loan?

Personal loan is a secured one, in this you have more risk, due to which the interest rate is high. Whereas auto loan is secured because in this you can buy a vehicle by keeping your property, you get a low interest rate in it.

- Can I buy a car in personal loan?

Yes, you can buy a car in personal loan but in this you have to pay a higher interest rate.

- Documents required for auto loan?

Usually you need identity card, income certificate, residence certificate, driving license for auto loan.

- Can I get a personal loan with low credit score?

It is quite difficult to get a personal loan with low credit score because in this the banks give you some loan rates which can vary on the basis of your credit score.

- Can auto loan be used to buy old car?

Yes, the rate of auto loan can be used to buy old car, but in this the bank gives you loan only on the basis of various conditions.