Introduction

In today’s era of financial provision, having a checking account is extremely important for one.How to Open a Checking Account It not only secures your money but also helps you easily make online transactions, credit card or bill payments and other activities. It is mainly used in the US where digital banking is growing rapidly, and checking accounts are often also called savings accounts in the US. It is an important financial tool. If you want to understand the process of opening a checking account, read on. We will provide you step by step the necessary documents, and important tips so that you can easily open your checking account.

Table of Contents

What is a Checking Account?

A checking account is an account that is used for everyday transactions. It also allows you to use your debit card, write checks or make online payments and withdraw money at any time. In the US, checking accounts are also commonly known as savings accounts or current accounts. It allows people to make regular purchases or receive paychecks in order to make purchases.

More Read-what is interest saving balance june 2025

Benefits of opening a checking account

Security- Keeping a bank account secures your money immediately.

Convenience- Checking account helps you to make transactions easily through your debit card, online banking and mobile one.

Records- It helps you to manage your documents as well as keep a record of all your transactions.

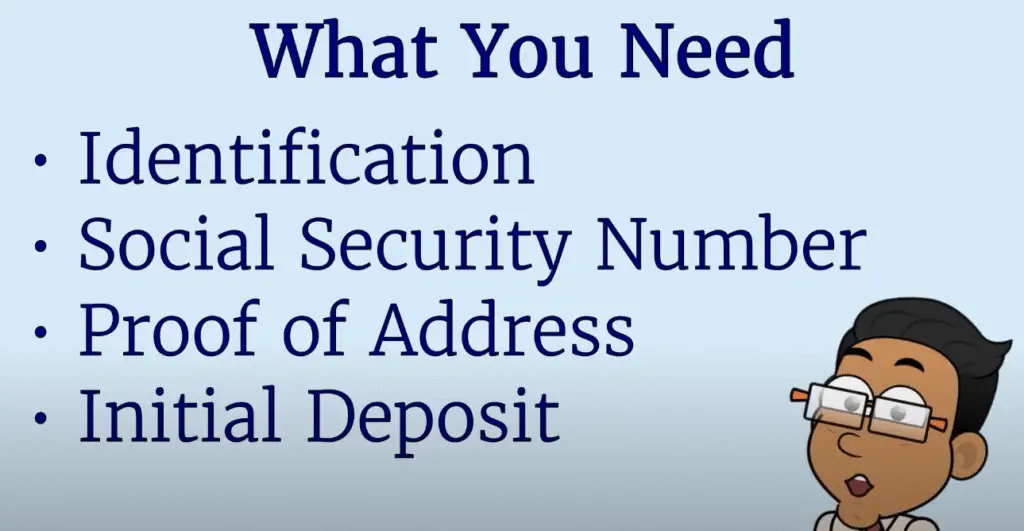

Documents required to open a checking account

- Identity proof: Aadhaar card, PAN card, passport, voter ID card, driving license.

- Address proof: Aadhaar card, passport, electricity bill, ration card, rent agreement

- Passport size photos: Usually 4-5 recent photos.

- PAN Card: Mandatory for income tax returns and financial transactions.

- Proof of Income: Salary slip, income tax return, or business related documents especially for current account.

Process of opening a checking account

Opening a checking account is a simple process, which you can do both online or offline. Below is the step-by-step process:

- Select the right bank

- State Bank of India, DFC Bank, ICICI Bank, Axis Bank, National Bank

- Minimum balance requirement. Debit card and online banking facilities

- Availability of branches and ATMs, Quality of customer service

- Select the account type

Decide whether you want a savings account or a current account. If you are opening an account for personal use, a savings account will be suitable.

- Submit documents

You can submit all the documents from the online application. If you are submitting documents, upload the copies in it.

- KYC

You will also have to do KYC in your bank. You can also do the KYC process online through the website.

- Activation

After checking the documents, your account gets activated and you also get a check book, debit card, online banking password.

Conclusion

So, in this article, we have told you about the simple way to open a checking account, which makes your financial life a confluence. Whether you use online banking or not, choosing the right bank and the right government accounts is important. For this, you will have to keep some necessary documents ready, understand the terms of the banks. Open a checking account according to your need. After opening an account, you can take advantage of digital transactions, bill payments, and financial activities. It not only protects your money but also gives you special freedom. Frequently asked questions are given below

(FAQ)

- What is the difference between a checking account and a savings account?

There is a difference between a checking account and a savings account, but savings accounts pay interest while current accounts do not pay interest, but current accounts allow you to do more transactions.

- Can I open an account without a minimum balance?

Yes, you can open a zero balance account without any minimum balance. There is no requirement to maintain a minimum balance.

- How long does it take to open an account online?

It usually takes 12-48 hours to open an account online, provided all documents are complete and correct.

- Is it possible to open an account without an Aadhaar card?

Yes, you can open an account without an Aadhaar card. You will need a passport or other documents.

- Do I need a checkbook?

No, checkbooks are an option whether you are opening an account with a debit card or online banking.